End-to-End

Wholesale & Retail CBDC Platform

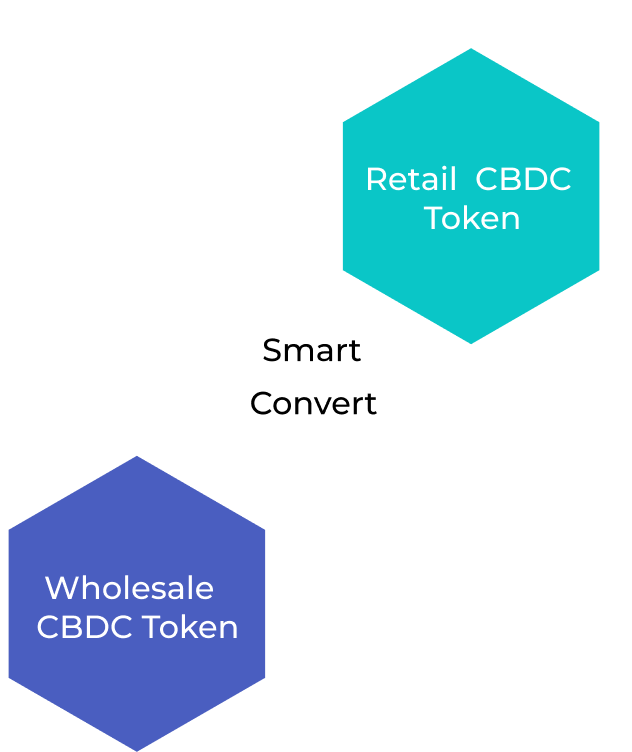

Wholesale CBDC Module

Wholesale CBDC Module

Digital Asset Management Module, for currency issuance and interbank transactions, reducing the settlement risk with domestic and international counterparties by leveraging a Distributed Ledger Technology (DLT).

Retail CBDC Module

Retail CBDC Module

A retail CBDC, with cash-like attributes, such as high accessibility and high availability. A retail CBDC token that ensures privacy-preserving features, to enable trust and adoption by individuals and institutions alike.

How It Works

Discover our versatile CBDC platform designed to serve both central banks and the private sector, fostering financial inclusion through the use of Distributed Ledger Technology

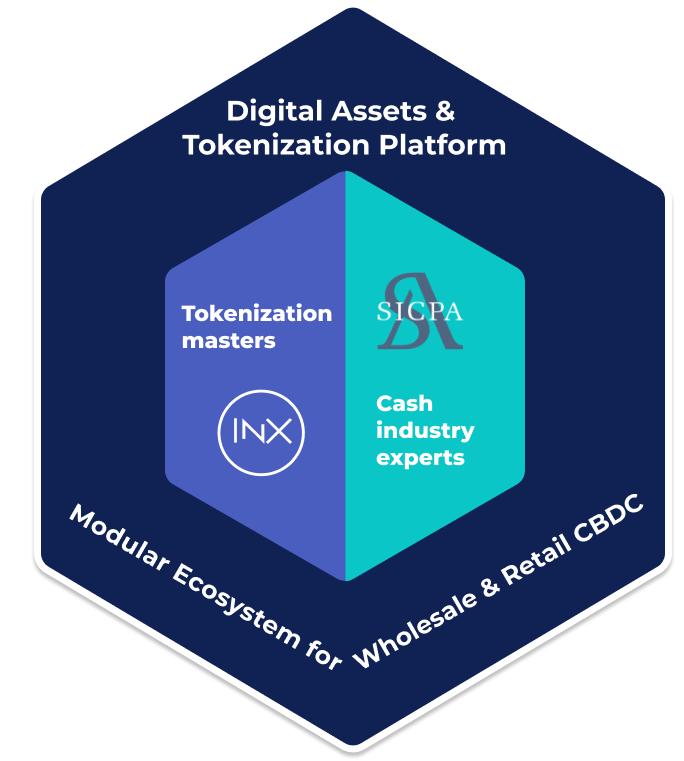

A Joint Venture by SICPA & INX

Nabatech is a technology company developing a CBDC ecosystem to support monetary sovereignty in the rapidly evolving digital landscape.

Our long-standing relationships with sovereigns and regulators worldwide strengthen our mission in delivering an industry-leading platform using innovative technologies.

More about NabatechWe’d love to hear from you, and

get in touch for a demo

You can reach us anytime via [email protected] or just fill the form below