Striking a Balance: Exploring a best of breed design Between Account-Based and Token-Based Approaches for Optimal CBDC Implementation

20/11/2023, By Paz Diamant, CTO of Nabatech.

In the ever-evolving landscape of Central Bank Digital Currencies (CBDCs), the choice between account-based and token-based approaches constitutes a pivotal decision with far-reaching implications.

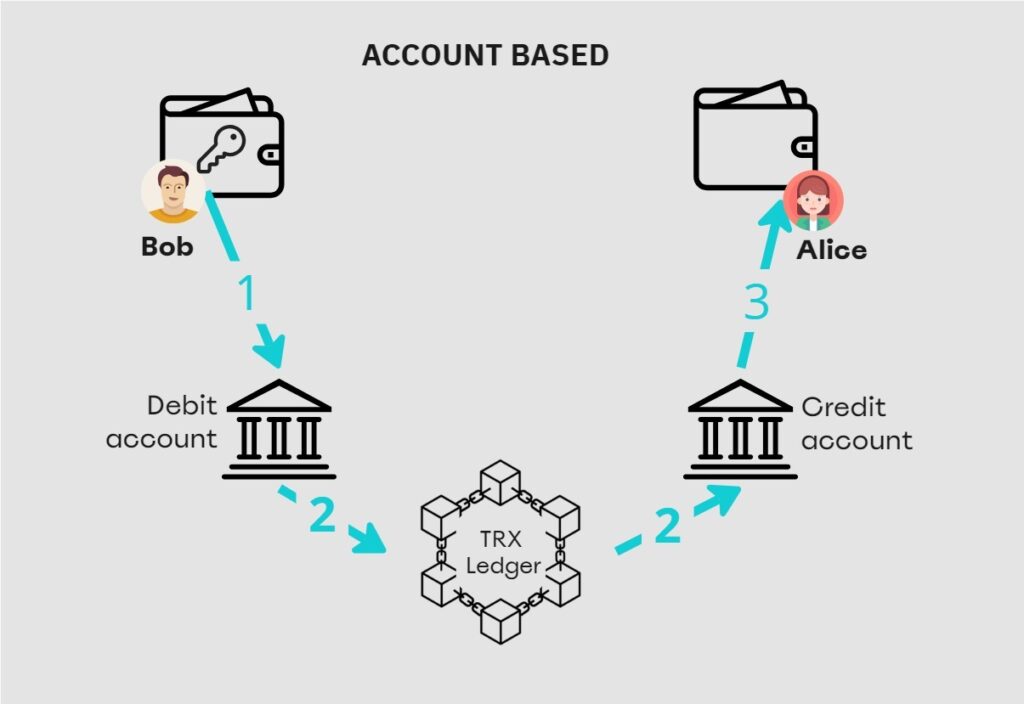

Account-Based Approach: Balancing Trust and Efficiency

In the account-based system for Central Bank Digital Currencies (CBDCs), user identity verification and balance confirmation by a trusted third party are routine steps before transactions. This process is designed to prevent double-spending. The subtle challenge lies in finding a seamless balance between security and operational efficiency within CBDC systems. Its a familiar and traditionally trusted process, embraced by the current financial system.

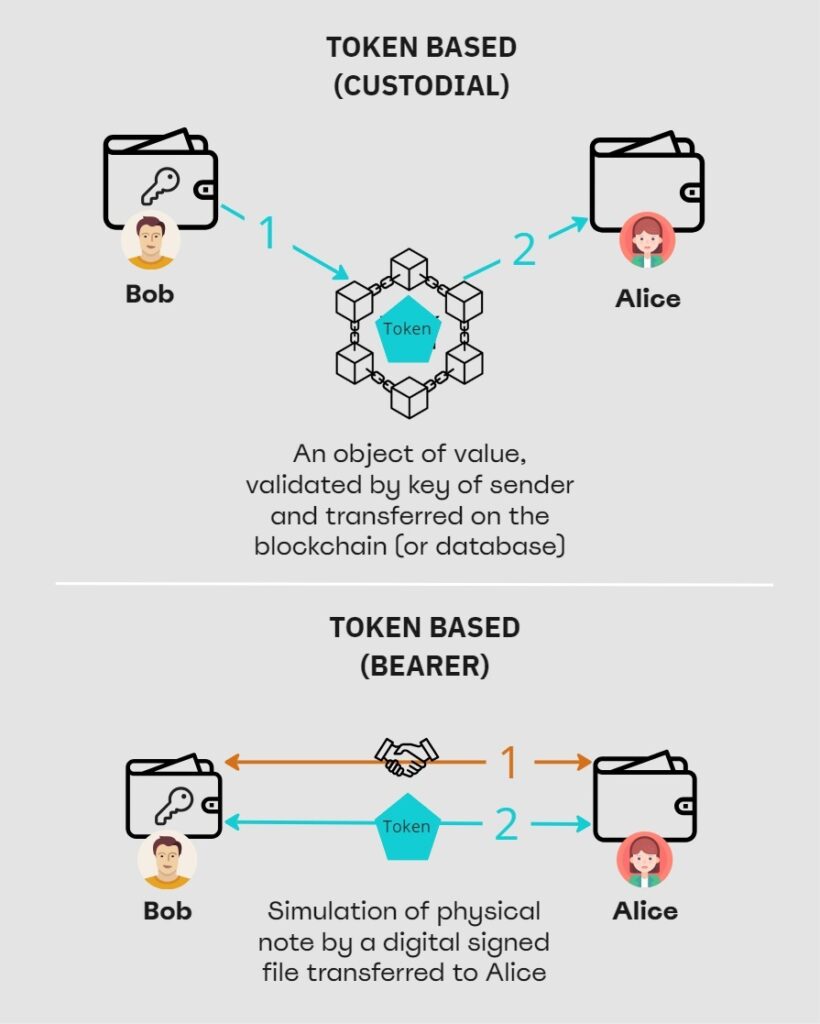

Token-Based Approach: Pioneering Privacy and Cash-Like Transactions

In contrast, the token-based approach eliminates the need to check a customer’s balance before approval. Reducing reliance on pre-transaction balance verification. This model excels in facilitating offline transactions, providing a direct, peer-to-peer experience. This approach prioritizes privacy, offering a cash-like experience. Tokens are bearer instruments on the user’s device, ensuring secure and efficient transactions.

Despite its innovative features, the token-based system faces challenges, notably the associated risk of losing a private key. However, solutions exist to maintain ownership control in the event of key loss, providing reassurance to users.

The journey towards a resilient and inclusive CBDC future involves navigating the diverse dimensions of account-based and token-based approaches, embracing the strengths of each to forge a path forward.

Striking a Balance: The Evolution of Account-Based CBDC

In the pursuit of a more resilient, trusted, and inclusive CBDC solution for both retail and wholesale customers, it becomes evident that neither the account-based nor the token-based approach is a one size-fits-all solution. The optimal path lies in a nuanced understanding of the advantages and drawbacks of each approach, leading to a hybrid model that maximizes benefits while mitigating weaknesses.

Recently, a third path has been paved. Nabatech, working in collaboration with blockchain and monetary experts, has pioneered advancements in the account-based CBDC model. By strategically addressing the drawbacks associated with account-based systems, Nabatech’s solution showcases a privacy-first design, support for offline transactions, and scalability with high performance. The platform’s incorporation of sharding on the blockchain infrastructure, coupled with the use of the RUST development language, underscores the commitment to enhancing response and execution times, thereby overcoming traditional limitations.

Nabatech’s account-based architecture, strengthened by design principles that address scalability, privacy, and offline support, stands out as a holistic solution. It maintains the familiar structure of the financial system, with the financial institution (FI) retaining control over user accounts. This continuity ensures a smooth transition for users, fostering confidence in key recovery and enhancing overall security. Upholding the traditional relationship between users and FIs not only facilitates CBDC adoption but also establishes a responsive layer of service from the FI, further bolstering user confidence in security measures.

In this era of embracing innovative and efficient paradigms, the combined CBDC solution subtly embodies the uncompromising standards that define our digital landscape, particularly in enhancing safety, privacy, and efficiency across both online and offline realms.